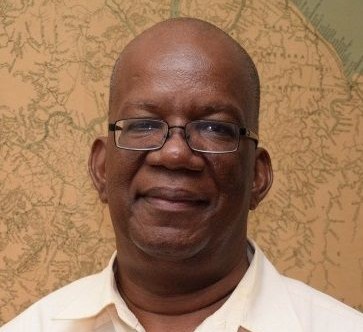

Winston Jordan

May 13 2018

The Government of Guyana is now able to stand as guarantor for loans secured by any public corporation up to and including $50 billion.

Just after 10 pm on Friday and in the face of objections from the opposition People Progressive Party/Civic (PPP/C) a motion to this effect was passed in Parliament by the APNU+AFC majority.

In presenting the motion, Minister of Finance Winston Jordan noted that in light of government’s impending guarantee of a $30 billion syndicated bond for the Guyana Sugar Corporation (GuySuCo) “it has become urgent” that government is able to stand guarantor.

Jordan cited the Guarantee of Loans (Public Corporations and Companies) Act Sections 3 (1), 2(2) and 4 (1). It is section 4(1) which before Friday specified that the aggregate amount of liabilities of government as guarantor shall not exceed $1 billion.

However Jordan told the House that “It has become necessary to specify a greater sum for the purpose of enabling aggregate amount of the liability of the government in respect of the guarantees to be increased in respect of those incorporated bodies to which the act applies in accordance with developmental policy”.

He noted that in 2013 an increase to $50 billion was approved in relation to the Amaila Falls Hydropower Project but now the need is for the same provision to be available to other developmental projects as determined by the government.

According to Jordan the motion should have been non-contentious as the increased limit was already approved in 2013 but for a rider.

Those who hammered out the amendment then, he argued did not know that in putting a rider they would have created a problem for the government since it could not guarantee any other corporation.

He stressed that the House was being approached to extend the rider not remove it.

Opposition Chief Whip Gail Teixeira was unimpressed with this argument. She noted that the motion was an important one which should have been discussed with the opposition before its presentation in the House as was done in 2013.

She said that she found it ironic when Jordan said that the rider hindered government since it was the AFC which demanded the rider. Teixeira also noted that the Amaila Falls Hydropower project stalled after the APNU failed to support the motion for which stakeholder companies had sought a unanimous vote.

For Teixeira the motion was a signal that government intends to be involved in “more and more massive borrowing.”

She further noted that in 2013 government was not guaranteeing a debt but was guaranteeing a contingent liability.

In such a case Government would have only become liable if the Guyana Power and Light refused to buy the power or pay for the power bought under a Power Purchase Agreement, the opposition clarified in a press statement yesterday.

According to the statement the opposition had been told that the $30 billion syndicated bond was being collateralized by the assets of GuySuCo now held by NICIL.

Noting that these assets “are valued far in excess of $30 billion dollars the PPP/C questioned why government needed to stand as guarantor.

Stabroek News had reported on March 28 that the $30 billion bond was not likely to be a burden on government.

A financial analyst had explained to this newspaper that “GuySuCo is not high risk, it is very low risk, because while I don’t know the exact value of GuySuCo, I know it is worth a lot more than thirty billion dollars. So you see, the small margin comes about because the bond is backed by the collateral.

The same report noted that Republic Bank (Guyana) Ltd, the Guyana Bank for Trade and Industry and other local banks are participating in the syndicated bond along with some regional input.

Jordan had confirmed that Republic Bank is a major participant, noting that the bond has been secured at an interest rate of 4.75%.

“It will be disbursed in tranches… repayment in 5 years with one year grace,” Jordan explained.

Again the opposition was less than impressed, in yesterday’s statement they explained that loans that are fully collateralized and further secured by a Government guarantee, attract far lower interest rates than those about which Jordan boasted.

“This is so because the risk is de minimis. The question that must be asked of Republic Bank is; would it be prepared to extend the same terms and facilities to another borrower with similarly strong collateral? Or, is there some quid pro quo arrangement in place between this bank and the Government,” the PPP statement questioned.

It further argued that the motion has laid the foundation for large scale borrowing without Parliamentary scrutiny as was done under the Burnham/Hoyte governments.

“The nation will only learn of the bankruptcy when it is too late. We must point out that the debt accumulated from 2015-2018 plus the 30 Billion from Republic Bank, coupled with the 900 Million USD which will be borrowed from the Islamic Development Bank (IsDB) doubles the total debt which the PPP left after 24 years in Government,” the statement added.

The government has said that US$900m is potentially available from the IsDB but projects have to first be presented for funding before any of this is tapped.