Chicken feed money and cost issues

By Tarron Khemraj OnIn Business Page |

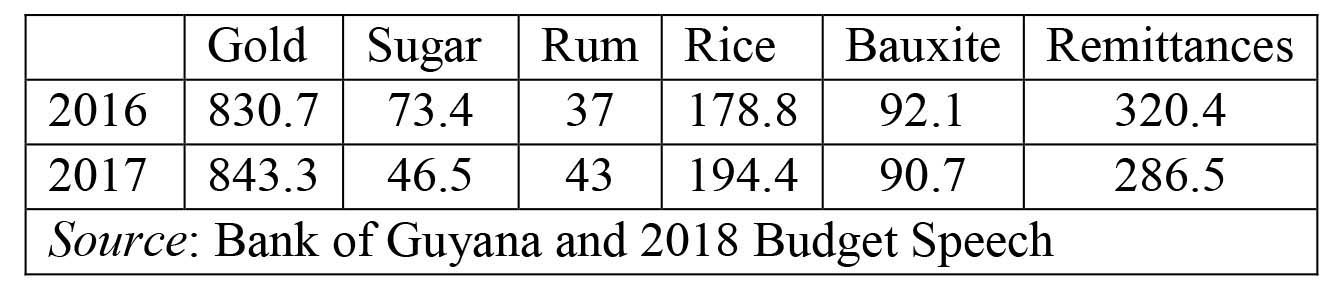

The previous six columns asked the question whether Guyana could escape the natural resource curse. We have looked at the issue from various dimensions. In particular, we have observed that initial conditions prevailing in Guyana must be taken into account when making such a prediction. The present structure of the production economy and limited economic research capacity in the public service were identified as initial conditions that must be surmounted if the country is to evade the curse. There are still a few crucial initial conditions we must explore; therefore, we will continue probing this crucial question in a fortnight.

Today let us examine the heightened debate about the amount of revenue Guyana will realize. The government’s side of the debate was presented by Minister Dominic Gaskin. He sought to shift the debate away from the percentages, rates and bonus to the expected aggregate inflow of revenues the government is likely to realize once production reaches 500,000 barrels per day. Mr Gaskin made a good point that Guyana does not have the capacity to exploit this natural resource. Therefore, a partner with finance capital is needed. He noted also that going back on the contract will send a message of uncertainty to foreign investors.

Ms Kimberly Brasington from the local affiliate of ExxonMobil echoed a similar perspective about reneging on the contract at this stage. While Mr Gaskin was more aggressive in his posture, Ms Brasington delivered a subtle threat. She made it clear that changing the contract now will turn investors away from Guyana. The threat is credible since this is the way world capitalists operate. They not only read the news and follow keenly the business and financial press, but also meet at country clubs and golf courses. If they want to disrupt your market access they will do just that.

Guyana’s nationalization in the 1970s resulted in failed industries, particularly bauxite, not because Guyanese talent could not manage those industries, but more because market access was disrupted. Venezuela did not turn out well after nationalizing ExxonMobil’s assets in 2007. The ultra-capitalist Forbes Magazine calls Chavez’s nationalization ‘theft’. In a 2014 article the magazine noted that Venezuela still owes ExxonMobil US$1.6 billion for the theft of assets. Last year the Washington Post speculated that ExxonMobil’s Guyana strategy might not only be about economics, but also to get back at the extreme left-wing government there. Guyana might want to consider this factor, particularly since a right-wing government willing to make peace with ExxonMobil could get back into power over there.

Minister Gaskin does not want us to consider the gross revenues because the percentages and the signing bonus are in favour of ExxonMobil. All the market analysts and the economic analyses I have seen indicate that Guyana’s fiscal intake is under 40%. In other words, after accounting for royalty and 50/50 profit share, Guyana gets about 37% of revenues over the lifetime of the project. The bonus is just too low. It is clear the Granger government did not do the research. Furthermore, no one is asking for an exorbitant bonus. When I calculated a reasonable bonus, I accounted for the fact that ExxonMobil has a specific cost of capital or discount rate. A bonus of around US$200 million would not have disrupted its cost of capital.

In addition, some kind of proportionality could have been negotiated on the government’s side when market price exceeds certain upper thresholds. If the price increases to US$70, US$80 or US$100 per barrel, Guyana still receives 50% of profit after accounting for unit or average total cost.

In spite of the fact that the Guyana Government agreed to a 50/50 profit share, I can’t get a sense of how long it will take for ExxonMobil to recoup its fixed costs of exploration, development and pre-contract expenses. I believe Annex C of the contract is written to confuse the general public. It allows for enough leakages so that it will be hard to pin down the average cost. Annex C classifies all costs as exploration costs, development costs, operating costs and the pre-contract expense of US$460.2 million.

There is no cut off period for when exploration, development and pre-contract costs are recovered. This is important from a time value of money perspective and for the long-term average operating cost. The latter will have a direct impact on the 50/50 profit share. Furthermore, it is surprising from a non-discounting valuation standpoint why ExxonMobil would want to spread out long into the future its pre-production expenses such as development costs, exploration costs and the pre-contract expense. This just adds uncertainty to what exactly is the average total cost, which using the lingo of Annex C is the average (or per barrel) cost of exploration, development, operating and pre-contract expenses.

We were reassured by Ms Brasington that ExxonMobil will be fair with respect to the average total cost. However, we have to be aware of the global corporate governance framework under which this giant multinational conducts its business. We examined the corporate governance philosophy a few columns ago. Reuters reported on March 7 that ExxonMobil’s operating margin – the difference between revenues and variable costs – is 5.1%, a number significantly lower than the industry’s average of 13.5%. In the same Reuters article, ExxonMobil is making a commitment to increasing its operating margin by 2025. The retirement bonus of top management is resting on this outcome.

ExxonMobil played its best strategy that allowed the global giant to win a contract in its favour. However, a contract is a contract and there is probably not much room now to get out of it without incurring the wrath of the global capitalists. The Guyana government has signed off on a contract without seeking more information through a more inclusive approach. The APNU+AFC government played a strategy with limited information, which no doubt was motivated by pure political calculations. A few of the foreign “oil experts” the APNU+AFC government brought in to make speeches just had absolutely nothing new to say. The result is Guyana will not obtain an optimal amount of revenues while the demand for these will be great.

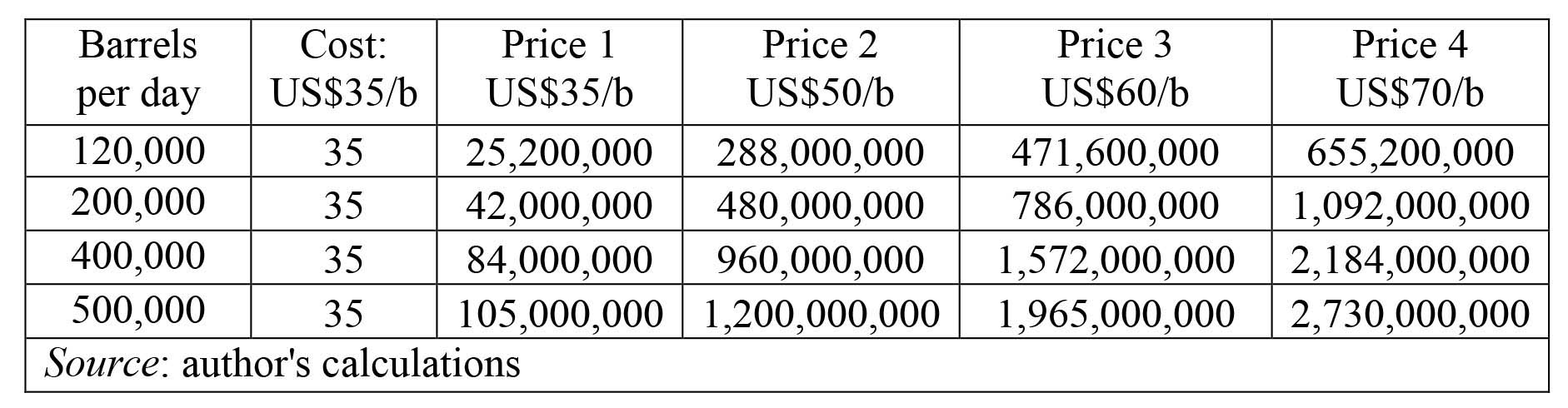

This is why Mr Gaskin and others want us to focus on the gross revenues that will flow to central government, which will decide how to spend among competing interests. There are however a few estimates of what average operating cost is likely to be. The IMF did its calculations relying on an operating cost of US$20.4 per barrel. Hess disclosed a much lower average operating cost. Mr Christopher Ram disclosed to me an average total cost of about US$35 per barrel. His number includes the pre-production expenses as well as operating costs. However, I am still bothered that there is no clear indication of when these pre-production costs would be recouped.

In the next column, I will use these cost estimates to simulate scenarios of revenues flowing to central government. I will examine Mr Gaskin’s chicken feed thesis. Chicken feed money has to be determined in the context of the demand for the revenues, not just how much is expected to flow into the government’s bank account.

Copyright © 2017 Stabroek News. All rights reserved.