Insurance Industry Bill to be tabled Wednesday — seeks to regularise the industry, protect consumers and promote competition

THE Insurance Bill 2016, which seeks to provide greater regularisation and to bring the insurance industry on par with international norms, will be tabled in the House next Wednesday by Finance Minister Winston Jordan.The Bill provides for the regulation of insurance in Guyana, the promotion of competition in the insurance industry, the protection of consumers and to repeal the 1998 and 2009 Acts on insurance and for related matters.

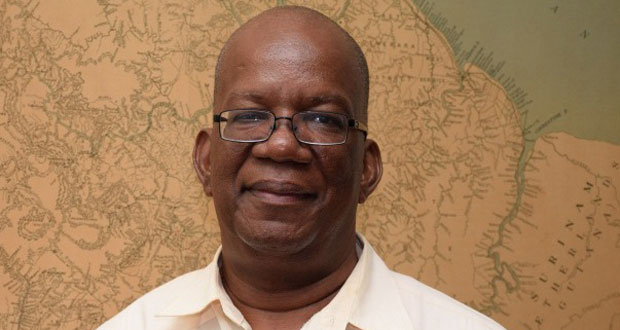

Finance Minister Winston Jordan

Finance Minister Winston Jordan

According to its explanatory memorandum, the Bill has been designed on a framework basis and to a significant extent, only core requirements have been included in the proposed law itself.

The Bill is generally in keeping with international standards, but modified somewhat to take account of the current development of the insurance industry in Guyana.

The overall approach is to avoid detailed rules and instead to include risk-based approaches consistent with sound business and financial practices. Other provisions have been left to regulation.

The memorandum noted that following its assumption of responsibility for much of the non-bank financial sector in Guyana, the Bank of Guyana has taken steps to bring its regulatory framework and supervisory capacity in these areas into line with current international norms in a manner that is appropriate to the stage of development of the country and the relevant subsectors.

A subsidiary objective is to support the healthy development of the non-bank sector.

The diagnostic was supported by the World Bank and involved full discussions with industry participants.

It found that the insurance sector in Guyana is underdeveloped relative to its peers. Structural and economic factors contributing to this include low population density and high recent inflation rates.

Industry-specific factors include heavy competition pushing down non-life premiums, loss of confidence following the global credit crisis and the subsequent Clico failure (which saw nominal domestic life insurance premiums reduce by 80 per cent over three years, direct overseas placement of mega risks funded by foreign governments, low risk retention and the uninsurability of some major property risks in Georgetown.

The diagnostic also found that the industry is significantly overcapitalised relative to current volumes and risk levels, is conservatively managed, and there is no evident systemic risk potential.

The pension sector is still largely unsupervised, except to the extent that it is managed by insurers, and a significant increase in supervisory resources is needed.

A basic regulatory and supervisory structure is in place and has been functioning relatively well in the last few years.

“However, the current law/regulations and supervisory infrastructure would not be able to withstand another CL Financial-type situation. For this reason, the insurance and pensions law needs to be significantly upgraded to reflect international developments over the last decade and in particular to be made much more explicit regarding relevant prudential standards and the intervention powers of the bank. On the other hand, any reforms need to reflect limited human and systems resources,” the memorandum said.

Key changes required include allowing for removing the insurance supervisory function from the Ministry of Finance to the Bank of Guyana, the introduction of solvency rules (including corrective action triggers), updating governance requirements (and in particular requiring key board committees), more frequent and intense certification of the assets covering policyholder and member-related liabilities, authority to share information where appropriate, stronger fit and proper oversight of key individuals, winding up rules and processes that recognise policyholder priority, and the development of more flexible and lower cost consumer protection mechanisms.