$230 to US$1 – Exchange rate for US dollar hits all-time high

Something noteworthy is happening in the local foreign currency trade, with rates hitting up to $230 in one city bank this week.

The matter has raised alarm bells for the Guyana Manufacturing and Services Association (GMSA), with Central Bank yesterday saying that it will investigate.

According to the GMSA yesterday, the matter was raised at a recently-held meeting of its Board of Directors, who deliberated deeply on the “woes” of the manufacturing sector.

“The board is disappointed at the rate of deterioration of the Guyana dollar and has estimated that the real exchange rate, when available, being used for the purchase of foreign exchange is $230.00, for the replacement of imported inputs into the sectors.”

And indeed, it appeared that at least one bank was charging that much.

Yesterday, Kaieteur News’ Accounts Department reported that it was told by the Foreign Trade department of Republic Bank, Water Street, that the selling rate for US for wiring large amounts was $230. However, that would be in stark contrast to the rates being advertised by commercial banks yesterday.

Trinidadian-owned Republic Bank’s online selling rates were for electronic transfers- $210 with buying at $208.50 for US$1. Notes were being sold for $210 while purchases were at $207.

The website of the privately-run Guyana Bank for Trade and Industry (GBTI) seemed a little way off as it was buying notes for $200 and selling for $210. Under Central Bank regulations, the spread is not supposed to be more than $3. For others (drafts and transfers) the rates at GBTI were $210 while purchases were $204.

Contacted yesterday, Governor of Central Bank, Dr. Gobind Ganga, expressed surprise at the development, as his information differed from the findings presented by Kaieteur News. He said that indeed that he had heard of a $230 rate but these, he was told, were only for credit cards. The official pointed out that credit cards have higher charges and feeds.

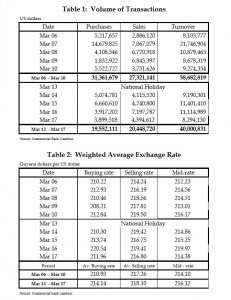

According to his figures, the average weighted purchased of US by commercial banks was around $215, while sale of the US dollar was hovering just over $219.

As of this week, commercial banks reportedly had over US$13.3M between them, with commitments up to US$10M.

“That means, according to the information submitted by the commercial banks, we have around US$3M available to be sold. We will be checking,” Dr. Ganga assured.

According to the GMSA, it is concerned over its members’ ability to keep prices stable. This will be exacerbated by the climbing rates.

“The burden of the changes in the VAT regime will also cause production costs to move upwards. The GMSA is encouraging all of the sectors to implement cost cutting exercises, and has noted that some entities have started to rationalize employment,” the body warned.

“The rise in the price of the U.S. dollar will have far reaching effects on our country as a whole, both socially and economically. We call on the Minister of Finance to hold broad consultations on this matter, urgently.”

GMSA also urged the Bank of Guyana and the Government of Guyana to take steps to stabilize the value of the Guyana dollar immediately, by injecting funds into the system “as we believe that the rate is being driven by the simple economic formula of supply and demand”.

“This situation has the potential to further increase unemployment and at worst, wipe out companies,” GMSA stressed.

The rates have been climbing in recent weeks with accusations that cambios were involved in a number of irregular transactions. It would be a difficult task to track this.

In recent months, a number of things have happened in the economy. A clampdown on gold smuggling and anti-drugs smuggling efforts, especially with the presence of the US Drug Enforcement Agency, has reduced the amount of cash floating around.

The fact that traders from Trinidad and Barbados have been buying up the US has not been helping the situation.

Central Bank has halted its purchases of currencies from both countries to help boost the US dollar trade.

A boon to the economy has been the number of US dollars coming from Cuban traders who have taken advantage of the no-visa policy of Guyana for nationals of that Spanish-speaking country.

Suriname also has reportedly been snapping up a significant amount of foreign currency too from Guyana, with a number of companies opened here.

Central Bank has also been reporting that some large transfers were not legitimate.

Under regulations, banks have been asking for invoices and other documents to ensure transactions and demands are legitimate.

On top of this, a number of key sectors have failed to bring in precious foreign currency.

Forestry exports reportedly fell over 30 percent last year with rice and sugar raking in less.

The economy has been helped somewhat with the record-breaking gold production which reportedly brought in US$800M last year to the banks.

The financial institution is refuting those claims noting that “the rate quoted by GMSA is not a uniform transaction rate; rather, it is the online rate charged by one of the largest commercial banks in Guyana for its credit and debit card transactions, which represent a very small share of the Cambio market transactions.”

The financial institution is refuting those claims noting that “the rate quoted by GMSA is not a uniform transaction rate; rather, it is the online rate charged by one of the largest commercial banks in Guyana for its credit and debit card transactions, which represent a very small share of the Cambio market transactions.”